- #Where can i get a copy of my 2016 tax extension drivers#

- #Where can i get a copy of my 2016 tax extension upgrade#

- #Where can i get a copy of my 2016 tax extension plus#

Or contact TurboTax support during business hours and see if there are any other options available for accessing a prior year online tax return.

#Where can i get a copy of my 2016 tax extension upgrade#

Once the 2019 online editions become available in December, at that time you can start a 2019 return and upgrade to Plus.

#Where can i get a copy of my 2016 tax extension plus#

You will not be able to upgrade to the Plus edition for tax year 2018 since the TurboTax online editions for 2018 have closed to make way for the 2019 online editions. Tax return 2017 for non-resident taxpayers. Tax return 2018 for non-resident taxpayers. Tax return 2019 for non-resident taxpayers. This means Social Security cards, although you can typically take a copy of your most recent year’s tax return instead. Make a choice for the year for which you wish to file your income tax return and log in with your username and password, your DigiD or an EU-approved login method (eIDAS): Tax return 2020 for non-resident taxpayers.

#Where can i get a copy of my 2016 tax extension drivers#

The REAL ID Act, passed by Congress in 2005, enacted the 9/11 Commission’s recommendation that the Federal Government set standards for the issuance of sources of identification, such as drivers licenses. If another party is making the request on your behalf, they must submit to the department a copy of your authorization to request. TurboTax does not store online any returns completed using the desktop editions. Your tax preparer will require identifying information for you, your spouse (if you’re married), and your qualifying dependents, if applicable. Frequently asked questions and answers regarding the implementation the REAL ID Act. To receive copies of previously filed tax returns, you should complete and sign Form REV-467 and send it to: If you are requesting the release of your own tax records, you may also fax your request to 71. If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. You can also get free transcripts of your federal return from the IRS - įor a fee of $50 you can get a complete federal tax return from the IRS by completing Form 4506 - If you need to order forms, call Customer Services: Individuals: 804.367.8031 Businesses: 804.367.8037 To purchase Virginia Package X (copies of annual forms), complete and mail the Package X Order Form. Click on the Year and Click on Download/print return (PDF) Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show.

You can also purchase them at most office supply stores. To access your current or prior year online tax returns sign onto the TurboTax website with the userID you used to create the account - W2 forms are not available online or at the post office, you can request forms from the IRS and have them sent to you.

/cloudfront-us-east-1.images.arcpublishing.com/gray/LLBZH2UPP5GY3KRSCSQCYVIW6Q.jpg)

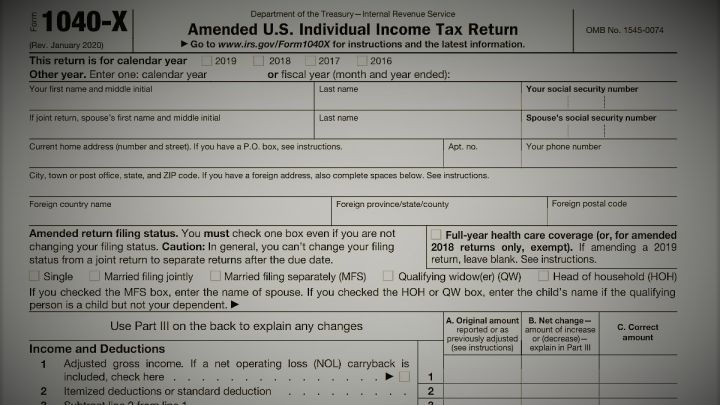

I need a copy of my 2018 Income Taxes, How can I get a copy of this?

0 kommentar(er)

0 kommentar(er)